By Suzanne Anarde-Devenport, RCAC Chief Executive Officer

By Suzanne Anarde-Devenport, RCAC Chief Executive Officer

To the surprise and dismay of rural housing advocates and practitioners across the country, the Senate proposed an increase in 502 interest rates for very low-income borrowers who utilize this premier rural mortgage product, including Mutual Self Help families.

I was in DC and met with USDA in late September and this was a primary topic. I want to share with you some of the facts on the 502 program, shared with the National Rural Housing Coalition by Bob Rapoza, and some data supporting the call for the 502 base interest rate to remain at 1%

What is the USDA Section 502 mortgage program?

The Section 502 direct loan program administered by the Rural Housing Service of the U.S. Department of Agriculture (USDA) provides direct long-term subsidized loans, as low as one percent, to rural households with incomes not exceeding 80 percent of median. As required by law, at least 40 percent of the loan funds available go to very low-income households – with incomes not exceeding 50 percent of median incomes. Section 502 is the only federal program of its kind and the most deeply targeted homeownership mortgage product in America.

Section 502 loans are made at a market interest rate, and subsidized at a graduated interest, depending on family income. Borrowers may obtain 100% financing, and loans are generally for 33 years (with a 38-year option for those below 60% of the area median household income), ensuring sustainable home ownership. Minority households make up 40 percent of Section 502 borrowers.

In many cases, Section 502 loans are used with the Mutual Self Help Housing program, which works with families who build their homes, gaining “sweat equity” through their labor.

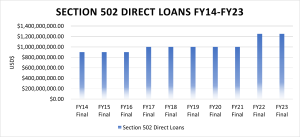

In Fiscal Year 2023 (FY 23), $1.25 billion is available for Section 502 loans, which financed roughly 5000 homeownership loans. Like other federal loan programs, the low-interest rate environment of recent years has made this program extremely cost-effective. The cost per loan for FY23 is less than $8000.

The History of 502

The 1 percent loan rate has existed since the early 1970s and is almost exclusively by very low-income households. Over the last 10 years, the annual program level for Section 502 loans has hovered around $1 billion.

The higher interest rate environment for FY 24 and limitations on domestic discretionary spending have made sustaining Section 502 challenging. Thus, the Senate recommends a fundamental change in the subsidy available to eligible households, increasing the floor on interest rates from 1 percent to 2 percent. This provision reduced the “price tag” if you will, for the interest subsidy.

What is the threat?

USDA has a statutory requirement that 40 percent of the funds, nationally and 30 percent on a state-by-state basis, of Section 502 loans are reserved for very low-income households. If loans at the 1 percent interest rate are unavailable, a substantial amount of Section 502 loan funds may go unobligated, which could lead to further reductions in the future. But, most importantly, the opportunity for homeownership disappears for so many very low-income rural families.

Why does it matter to me personally?

This topic is personal to me. The first home I owned was in New Mexico and financed with a USDA 502 loan. In 1996 when my mother passed away, owning a home was a critical component in my quest to adopt my two younger sisters. Homeownership is not just a wealth generator for rural very low-income families. It is so much more than that!

What can you do?

Reach out to your legislators and ask them to support retention of the 1% USDA Section 502 mortgage rate and share the impact the proposed increased interest rate will have on rural families and USDA’s ability to maintain the statutory requirement that 40% of those 502 mortgages support very low-income families attain homeownership.

Also in this issue of Self-Help Builder: