By Carrie Gable, RCAC rural development specialist – financial management

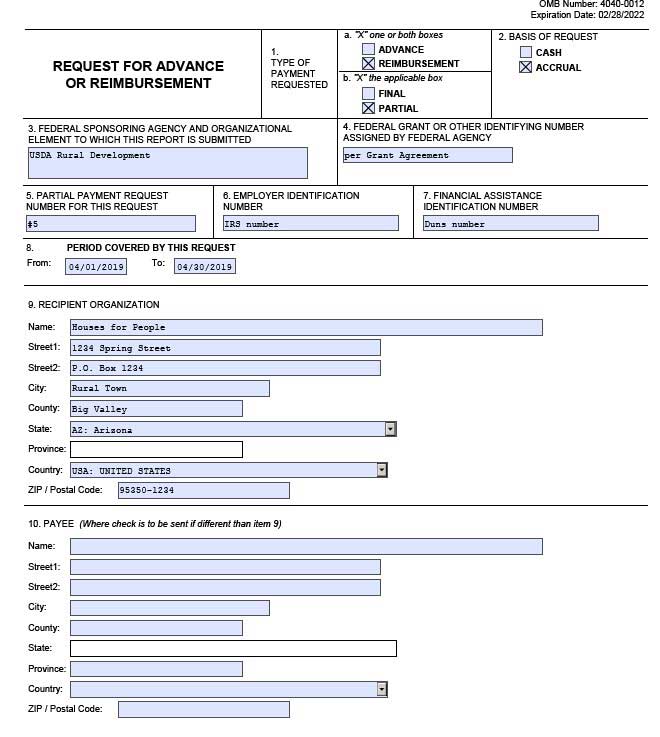

One of the most common forms in the self-help program is the SF-270 Request for Advance or Reimbursement. This is a required form and will be included in every 523 draw down for funds. Essentially, this form is to provide basic information about the grantee and financial information through the date of the reporting period. The form is used for numerous federal grants, therefore some of the fields are non-applicable to this grant. Below is a sample completed form for a self-help grantee, which includes information on fields that often cause confusion.

Page 1, numbers 1 – 10, provide basic information about the recipient’s organization. Most of this data is self-explanatory and easily found.

Please note the following information:

2 – BASIS OF REQUEST: If requesting an advance, all requests will be on cash basis.

- 4 – FEDERAL GRANT OR OTHER IDENTIFYING NUMBER ASSIGNED BY FEDERAL AGENCY: This identifying number will be found on the grantee’s grant agreement. If missing from the grant agreement, contact RD and request this. The FAIN (Federal Award Identification Number) is required per 2 CFR 200.210 Information Contained in Federal Award.

- 8 – PERIOD COVERED BY THIS REQUEST: The From date will always be the starting date of the grantee’s grant agreement. If requesting an advance, provide the To date to include the period that advance will cover.

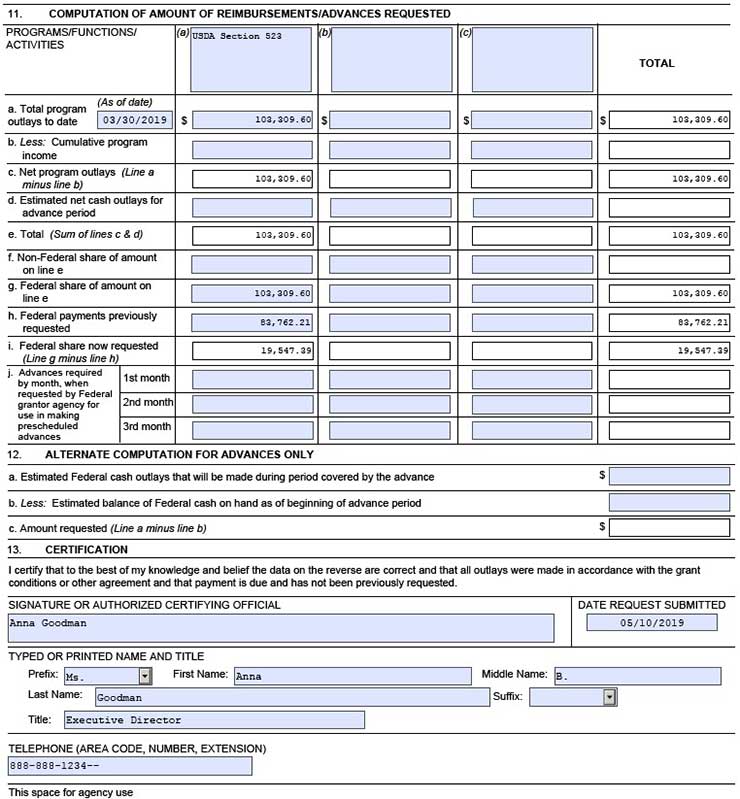

Page 2, numbers 11-13, provide detailed financial information that should be available directly from the recipient’s financial accounting system. Many of the fields are setup to automatically calculate in a fillable PDF and/or give you the cells to add or subtract.

Please note the following information:

- Columns B and C: These columns are used to provide space for grants that require cost breakdowns. These columns are not applicable to the Self Help grant.

- 11c, 11e, 11i and the TOTAL column – These fields will automatically calculate.

- 11a – TOTAL PROGRAM OUTLAYS TO DATE: The date will be the ending date of the period in which you have incurred expenses (outlays). This does NOT include the advance period. The dollar amount is the total expenses incurred through that date. **If requesting an advance, the advance amount will be listed on 11d.

- 11b – LESS: COMMULATIVE PROGRAM INCOME: This field is not applicable to the Self Help Program. There is no program income tracking and reporting requirement for the Self Help grant.

- 11d – ESTIMATED NET CASH OUTLAYS FOR ADVANCE PERIOD: If requesting an advance, the estimated advance amount is to be listed here.

- 11f – NON-FEDERAL SHARE OF AMOUNT ON LINE E: This field is used to show any non-federal grantee funds that were used in addition to the 523 grant to complete the grant requirements. It is typically only used on the grantee’s final draw down of funds. All other draws typically show $0 expenses in this field.

- 11g – FEDERAL SHARE OF AMOUNT ON LINE E: Will reflect the same total as 11f.

- 11h – FEDERAL PAYMENTS PREVIOUSLY REQUESTED: This field is used to show the total of all of the prior draw down of grant funds.

- 11j – ADVANCES REQUIRED BY MONTH: Non-applicable to the Self Help grant.

- 12 – ALTERNATE COMPUTATION FOR ADVANCES ONLY: Non-applicable to the Self Help grant.

This form and form instructions can be found at the following website: https://www.grants.gov/forms/post-award-reporting-forms.html. Keep the instruction page handy and ask questions. RCAC is here to help! We can assist you if you have questions related to any of the Self Help forms.