By Angela Sisco, RCAC RDS – Housing III

On June 2, 2023 U.S. Department of Agriculture Rural Development (USDA RD) issued PN 583. This seven-page PN makes significant changes to HB-1-3550 Chapters 4, 6 and 10 and to several handbook letters. Changes and clarifications have been made to income, credit, assets, determining repayment ability, other eligibility requirements, issuing the Certificate of Eligibility, updates to underwriting guidance related to refinance loans, allowable loan terms, and the annual loan quality review requirements and more! RCAC has gone through the changes and identified the new language (changes or clarification) and made comments where appropriate.

Please see the new language italicized below and RCAC’s comments in bold. If a section was left blank, or there are no comments, we thought it was self-explanatory or more focused on RD internal process and doesn’t affect your application processing.

Jump to Chapter 4 | Jump to Chapter 6 | Jump to Chapter 10

Chapter 4 – Purpose:

HB-1-3550, Chapter 4 is being revised to provide clarification to income, credit, assets, determining repayment ability, other eligibility requirements and issuing the Certificate of Eligibility. All website hyperlinks were checked for accuracy and updated accordingly throughout the chapter. Edits include but aren’t limited to:

Clarify ‘earned’ income of a full-time student is excluded after it exceeds $480 in Exhibit 4-1.

- NOTE: The earned income of a full-time student 18 years old or older who is not the Applicant, Co- Applicant/Borrower, or Spouse is excluded after it exceeds $480. All unearned income of a full-time student who is not the Applicant, Co-Applicant/Borrower, or Spouse is counted.

- This is a clarification of a policy that has been in place for several years. The 4-A calculator is designed to make this distinction of capturing the first $480 of earned income and all of unearned income.

Clarify the use of the Verification of Employment (VOE) and oral verification and added an example and guidance regarding comparing income (Paragraphs 4.2 (A)4., 4.2(A) 5. and 4.3 (E)).

- The Agency has no minimum history requirement for employment in a particular position. The key concept is whether the applicant has a history of receiving stable income and a reasonable expectation that the income will continue. Instead, the Loan Originator must carefully assess the applicant’s income to establish whether it can reasonably be expected to continue for the next two years (e.g., child support and contractual income). Nonetheless, most income cannot be guaranteed, nor will employers certify that income will continue for the next two years. A VOE should not be requested to obtain ‘probability of continued employment’ in order to make this determination. Instead, the Loan Originator and Loan Approval Official will compare projected income with the last two years of income (if applicable) to determine if the applicant has demonstrated an income level which is likely to continue.

- The need to use Form RD 1910-5, Request for Verification of Employment (VOE), to document previous employment (Part III of the form) should be rare and limited to cases where the preferred verification sources are insufficient to document the applicant’s employment history. The Loan Originator and Loan Approval Official will not routinely require a VOE or contact the employer. In some instances, less than two years of history may be acceptable when the applicant provides, and the Loan Originator documents sound justification. For example, an applicant whose compensation changed from hourly to salary income with the same employer in a similar job/position may be considered to have dependable and stable income. While not typical, more than two years of history (i.e., obtaining an additional year’s tax return) may be needed.

- For example, when an applicant’s income varies significantly from year to year, the Loan Originator may need to review a longer work/self-employment history to establish an average income. This can typically be accomplished by obtaining an additional year’s tax return with accompanying attachments. In no case will more than 3 years of history be obtained.…Written Verifications of Employment (VOE) provided by third-party sources or other similar documents prepared by third-party sources are only required when the applicant is unable to provide sufficient recent, reliable and consistent third-party documentation which is readily available to them (paystubs, award letters, etc.).

- 4.3(E) includes the Source of Income chart which has been updated accordingly (see handbook)

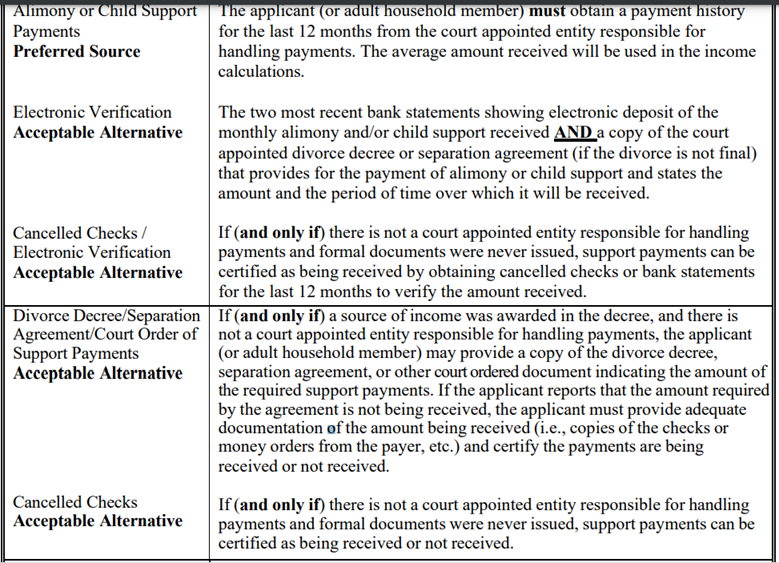

Update guidance on verifying child support when there is no written agreement or court decree, and funds are not received through a state agency. (Paragraphs 4.2 (A) 5. and 4.3 (E)).

- Other Sources of Income. Income from public assistance, child support (including back child support), alimony, or retirement that is consistently received is considered stable when such payments are based on: (1) a law, written agreement or court decree, or have been consistently received over a 12 month period (even if there is no written agreement or court decree), (2) the amount and regularity of the payments, (3) the eligibility criteria for the payments, such as the age of the child (when applicable) or the length of the alimony agreement, and (4) the availability of means to compel payments.

- 4.3(E) includes the Source of Income chart which has been updated accordingly, excerpt below on child support (see handbook for full Sources and Income chart)

Clarify unemployment associated with seasonal employment (Paragraph 4.2 (A) 5. and 4.3 (E)).

- The applicant must provide an explanation letter for employment gaps in excess of 30 days unless their income history is clearly seasonal in nature (e.g., construction, farm labor, recreational). The Loan Originator must review the employment gap explanation, as well as the historical/projected income to determine the applicant’s ability to receive stable and dependable income. If the Loan Originator determines that an applicant’s income source is unstable and undependable, the income must be excluded from repayment but included in annual income.

- 4.3(E) includes the Source of Income chart which has been updated accordingly (see handbook)

Add clarification and examples on how the Loan Originator should review the Income Worksheet submitted by a packager or self-help grantee (Paragraph 4.2 (B)).

- When a packager or self-help grantee submits Attachment 4-A, the name of the preparer will be provided. The Loan Originator will review the submitted Attachment 4-A and compare the data to the paystubs (i.e., no more than 60 days old) and historical data provided in the loan application package. If the income calculations are reasonable based on the data provided in the loan application package, the Loan Originator should concur and continue processing. If the income calculations are not supported by the paystubs and historical data provided, the Loan Originator will prepare a corrected version for the file. The corrected version will be retained with the original submission in the file. A copy of the corrected version, along with a brief explanation of what corrections were made and any resulting changes to the requested loan amount or eligibility, must be provided to the packager for their records.

- Note: This allows RD to concur with recommendations where paystubs are less than 60 days old, however, this doesn’t change the requirement on the 3-J stating the last four consecutive weeks of paystubs.

- There are two new Examples of when the packager and Loan Originator differ on the Attachment 4-A, Worksheet for Computing Income

Add clarification that paystubs should be no more than 60 days old (Paragraphs 4.2 (B) and 4.2 (E)).

- When a packager or self-help grantee submits Attachment 4-A, the name of the preparer will be provided. The Loan Originator will review the submitted Attachment 4-A and compare the data to the paystubs (i.e., no more than 60 days old) and historical data provided in the loan application package. If the income calculations are reasonable based on the data provided in the loan application package, the Loan Originator should concur and continue processing. If the income calculations are not supported by the paystubs and historical data provided, the Loan Originator will prepare a corrected version for the file. The corrected version will be retained with the original submission in the file. A copy of the corrected version, along with a brief explanation of what corrections were made and any resulting changes to the requested loan amount or eligibility, must be provided to the packager for their records.

Clarify self-employment business structures and the corresponding IRS forms needed, income analysis of each business structure and to clarify the deductions that can be added back into repayment income (Paragraph 4.3 (A) 2., 4.3 (E), and Attachment 4-C).

- The net income from the operation of a farm, business, or profession Below are certain deductions the IRS allows to reduce taxable income: (Refer to Attachment 4-C for guidance on what non-cash deductions can be added back to repayment income.)

- See Paragraph 4.3 (2) for the full list of deductions that can be added back to repayment income for self-employed (this is lengthy) and refer to Attachment 4-C for guidance on what documentation is needed for each business structure.

Clarify when recurring gifts paid toward a debt should be considered as income and included in the Total Debt (TD) ratio versus when they can be omitted from income and TD ratio (Paragraphs 4.3 (A) 7. and 4.22 (B) 2.).

- If another party provides funds to the applicant for a monthly debt (owed by the applicant), the recurring funds received by the applicant should be considered as recurring gift income and the debt must be included in the total debt (TD) ratio. If another party assumes the responsibility for the debt and pays the creditor directly, the payment paid directly to the creditor should not be included as recurring gift income and the debt can be excluded from the TD ratio (see Paragraph 4.22).

Add clarification to recurring monetary gifts when funds are received through Cash Applications (i.e., Venmo, PayPal, Zelle, etc.) (Paragraph 4.3 (A) 1.).

- Funds received for goods or services (e.g., piano lessons, home-based craft business, etc.) through centralized, online payment platforms (e.g., Cash Applications such as Venmo, PayPal, Zelle, etc.) should be considered if they appear to be recurring. If funds are not transferred to a U.S. Financial Institution (bank, credit union, etc.), the applicant must provide a transaction history from the Cash Application.

Update the SNAP benefit example to modify the monthly child support received to differ from the monthly SNAP benefit to avoid confusion (Paragraph 4.3 (B) 10).

- Income received from the Supplemental Nutrition Assistance Program (SNAP) may be considered to calculate repayment income in an amount not to exceed 20 percent of the total repayment income (“not to exceed” amount). The following provisions apply:

- Only the SNAP benefits attributable to the note signers can be considered for repayment income.

- Only the lesser of the “not to exceed” amount or the actual SNAP benefits can be included in the applicant’s repayment income.

- New example added including earned income, child support and SNAP (page 4-18).

Clarify retirement income and assets (Paragraphs 4.3 (C) 12., 4.5, Exhibit 4-3, Paragraphs 4.7 and 4.8) .

- Paragraphs 4.3 (C) 12 – Income earned on a retirement account (by non-retirees), from interest, dividends, or capital gains when funds can only be accessed by retiring, terminating employment, loaning against the account, or withdrawing with penalties.

- Paragraph 4.3 (C) – Income Never Considered for Annual and Repayment Income – the above has been added to this list

- Exhibit 4-3 – has been updated, removed Retirement Assets

- Paragraph 4.7 – For the purpose of computing annual income, the cash value of all non-retirement assets of all applicants and co-applicants, as well as all household members (adults and children), are considered. Reference Exhibit 4-1 for additional information. Form RD 3550-4, Employment and Asset Certification should be used to certify the cash value of the household’s family assets.

- Paragraph 4.8 – Note: for non-retired applicants income earned on a retirement account, from interest, dividends, or capital gains when funds can only be accessed by retiring, terminating employment, loaning against the account, or withdrawing with penalties is never considered for annual or repayment income.

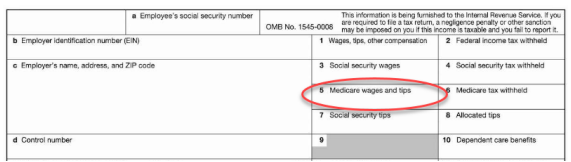

Clarify when review W-2 information, Block 5 is typically used for gross income (Paragraph 4.3 (E).

- …When reviewing W-2 information, Block 5 is typically used for gross income.

Add electronic verification or copy from the Financial Aid Office is the preferred verification source for Student Financial Aid (Paragraph 4.3 (E)).

- Student Financial Aid Preferred Source: Electronic verification or copy from the Financial Aid Office at the applicable school may be used to verify student financial aid.

Clarify Supplemental Verification Sources chart for Season Employment, Unemployment Benefits, Income and Assets if the applicant receives Social Security benefit through a Social Security debit card and Disability Assistance (Paragraph 4.3 (E)). Clarify the four calculation methods and to update the example to omit the oral verification reference (Paragraph 4.3 (E) 2.).

- 4.3(E) includes the Source of Income chart which has been updated accordingly (see handbook)

- To establish earning trends and avoid miscalculating income, all four methods should be considered; however, some income sources will only lend themselves to one method (such as seasonal income, retirement benefits, or social security benefits). If all four methods are not used, the Loan Originator must document why. In some cases, there may be multiple types of income generated from one source (overtime, bonus, hourly); therefore, the income calculation method used will depend on the type of income received, rather than the source of income.

Clarify verification of disability deduction can be done through receipt of disability income (Paragraph 4.4 (F).

- If the household member receives a form of income because of a verified disability (such as social security disability or disability compensation), that may be used as a method to verify the disability. Otherwise, Form RD 1944-4, Certification of Disability or Handicap, or other 3rd party documents prepared by a physician or other medical professional, should be used to verify the individual’s disability from a physician or other medical professional.

Update medical deduction guidance to correspond with language in HB-1-3550, Chapter 12 (Paragraph 4.4 (G)).

- Updated Examples of Typical Medical Expenses and Excluded Medical Expenses (page 4-38).

Clarify guidance on nontaxable income (Paragraph 4.4 (H)).

- Nontaxable income, such as Housing Choice Vouchers, social security, child support, or alimony payments (if the instrument was executed or modified after 12/31/18), will be multiplied by 120 percent to “gross up” such income (provided the nontaxable income is stable and is expected to continue for at least two years).

Remove the word ‘term’ in Exhibit 4-3 and clarify the cash value of life insurance policies are not to be considered in assets (Paragraph 4.5, Exhibit 4-3).

- The following types of assets are not considered. …The cash value of life insurance policies;…

Changes to Exhibit 4-4, Indicators of Unacceptable Credit, to clarify late payments on revolving and installment accounts are on a per account basis, not cumulative.

- Payments on any installment account, (on a per account basis, not cumulative of any and all of these account types), where the amount of the delinquency exceeded one installment for more than 30 days within the last 12months.

- Payments on any revolving account, (on a per account basis, not cumulative of any and all of these account types), which was delinquent for more than 30 days on two or more occasions within the last 12 months.

Add clarification of purpose of DNP portal, update DNP portal data sources, remove guidance to suspend application processing, clarify if there is a positive Do Not Pay that we would need the delinquency paid in full or on a payment arrangement with a history of payments and clarify if the delinquency is not resolved HB letter 15 should be issued to include the delinquent federal debt and all other reasons for denial. (Paragraph 4.11).

- The Do Not Pay (DNP) Portal is used to prevent Fraud, Waste, and Abuse of federal dollars. Except in very unusual circumstances, an applicant who is delinquent on a Federal debt is not eligible for the direct programs. The Loan Originator can verify whether the applicant has delinquent Federal debt through the DNP portal. Rural Development staff should visit the Agency’s DNP SharePoint page for more information including training, FAQ’s, newsletters, etc.:…

- See DNP (and DOL) requirements for additional information specifically for self-help grantees.

- If the delinquency is paid in full or if evidence of satisfactory payment arrangement with

- the debt agency has been reached with a 6-month history of payments can be provided within the 15-day time frame, application processing can continue.

- This clarifies that RD is allowed to continue to process the loan if documentation of payment in full or a history of 6 months of payments can be provided even if the debt has not been removed from the DNP portal.

To clarify that once an application is selected for processing, the Loan Originator should pull the tri-merge credit report to correspond with the guidance in Chapter 3 (Paragraph 4.12).

- Procedures for obtaining third-party verifications are described in Paragraph 3.15.

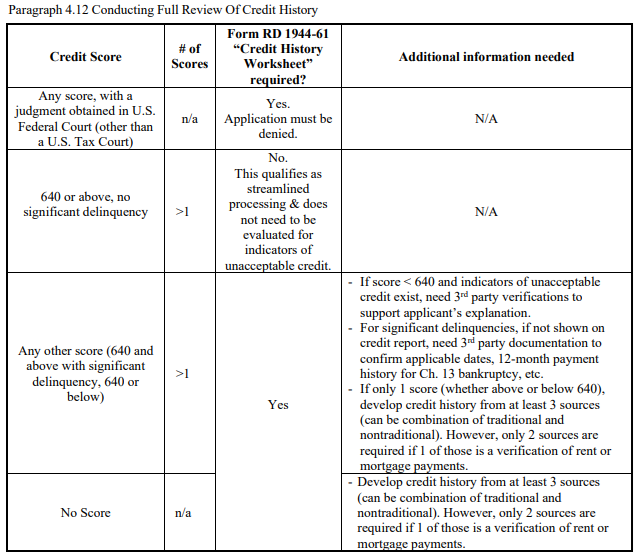

Added a chart to clarify what is needed for a credit review based on credit score, number of credit scores, tradelines and significant delinquency (Paragraph 4.12 (A)).

Added guidance for non-derogatory and derogatory disputed accounts (Paragraph 4.12 (B) and Paragraph 4.12 (D), Exhibit 4-5).

- Non-Derogatory Disputed Accounts: If the applicant has a non-derogatory disputed account, the Loan Originator can determine the non-derogatory disputed account acceptable and proceed with underwriting. The disputed account is considered non-derogatory if one of the following apply:

- The disputed account has a zero balance;

- The disputed account states “paid in full” or “resolved” on the credit report;

- The disputed account with late payments are aged 24 months or greater;

- The disputed account is current and paid as agreed.

- The applicant must provide the Agency with applicable documentation to support the reason and basis of the dispute with the creditor. The Loan Originator must determine the impact of the disputed account on the repayment of the proposed mortgage debt. The Loan Originator must include the minimum monthly payment stated on the credit report, five percent of the balance of the account, or the amount documented from the creditor for each account.

- Derogatory Disputed Accounts: Disputed derogatory credit accounts refer to disputed charge-off accounts, disputed collection accounts, and disputed accounts with late payments in the last 24 months.

- The Agency’s credit determination may be subject to change upon resolution of the derogatory disputed account. The Loan Originator must determine the impact of the disputed accounts on the repayment of the proposed mortgage debt. The Loan Originator must include the minimum monthly payment stated on the credit report, five percent of the balance of the account, or the amount documented from the creditor for each account. The Loan Originator may issue Form RD 1944-59, Certificate of Eligibility, subject to the receipt of the disputed resolution prior to approval.

- Previously any applications with accounts in dispute were typically denied as RD was unable to determine the impact on the Debt to Income Ratio. This change provides guidance on evaluating the impact of the accounts in dispute and a calculation for the Debt to Income.

Changed Landlord Verification to Verification of Rent and added the method of verifying rent by obtaining 24 months of canceled checks, money order receipts, or electronic payment confirmation paid directly to landlord (Paragraph 4.12 (C) 1.).

- The rental payment history may also be verified by obtaining the past 24 months of canceled checks, money order receipts, or electronic payment confirmation reflecting payments were made directly to the landlord.

- This change allows an alternative method of landlord verification.

Clarify that monthly subscriptions (i.e., Hulu, Netflix, Xbox, etc.) can be used as an alternative nontraditional credit source and should not be included in the Total Debt (TD) ratio (Paragraph 4.12 (C) 3.).

- Confirming the Existence of a Nontraditional Credit: Documentation to confirm that the nontraditional credit exists and that the applicant has sufficient credit references to evaluate his/her ability and willingness to repay debt may include a sufficient payment history from the following sources:

- … Alternative Sources: Payments to childcare providers (provided the provider is an established child care business); school tuition; payments to local retail stores; storage units companies; monthly subscriptions (e.g., Hulu, Netflix, Xbox, etc.); payment arrangements for the uninsured portion of any medical bills; a history of saving by regular deposits resulting in a balance equal to three months of the proposed mortgage payments; and similar credit sources. Child support paid is not an acceptable source. These expenses must not be included in the Total Debt (TD) ratio when calculating repayment ability.

Clarify that a 502 borrower may not have an outstanding RD direct or guaranteed loan at the same time and clarified guidance when an applicant owns an existing dwelling (Paragraph 4.15) .

- A 502 borrower may not have outstanding RD direct or guaranteed loans at the same time on two or more homes.

Add language to clarify when an applicant is presumed to be unable to obtain credit from other sources and added guidance if all four conditions met clarified when the applicant has the ability to obtain other credit (Paragraph 4.16).

- To be eligible, the applicant must be unable to obtain credit from other sources on terms and conditions they can reasonably be expected to fulfill. All applicants are presumed to be unable to obtain credit from other sources unless all four conditions apply: (1) the applicant is Low income; (2) the applicant has a credit score that is 680 or higher; (3) payment assistance is not needed and (4) the applicant has been with the same employer for at least two years.

Change long-term installment obligations with more than 10 (previously 6) months repayment remaining must be included in the TD ratio and added ‘including back child support payments’ as a long-term installment obligation. Also clarified when all four conditions are not met or a waiver has not been granted, the higher of the monthly student loan payment listed on the credit report or one-half percent (.50%) of the student loan balance must be used in the TD ratio. (Paragraph 4.22(B)1).

2. Establishing TD Total debt includes PITI, all long-term (non-medical) obligations, and short-term (non-medical) obligations that have a significant impact on repayment ability. The following items should be counted:

- …Long-term installment obligations with more than 10 months repayment remaining, including loans, alimony, and child support (including back child support payments), but excluding revolving accounts. Funds borrowed from a retirement account are excluded since the applicant is repaying a loan to themselves. In the event an applicant does not repay the loan as agreed, the debt is reported as taxable income during that tax year but will be treated as sporadic income. All medical debts (be it a collection, judgment, etc.) are excluded.

- …Student loan payments. The Loan Originator must use the actual monthly payment under the existing repayment plan (as verified by the lender) if (1) the loan is in repayment status, (2) the applicant has a credit score of 640 or higher, (3) the applicant has no significant delinquency as outlined in Paragraph 4.14 B., and (4) the applicant’s payment shock can be measured and is not more than 100%. If all four conditions are met and the applicant who is responsible for the student loan has, for example, a $0 monthly payment because they are on an income-driven repayment plan, there will be no student loan payment considered in the TD ratio. The State Office may grant a case by-case waiver to any condition if the overall risk assessment on the application warrants it and is well documented in the casefile. If all four conditions are not met or a waiver has not been granted, the higher of the monthly student loan payment listed on the credit report or one- half percent (.50%) of the student loan balance must be used in the TD ratio.

To clarify that the applicant’s file should be electronically maintained in the Electronic Customer File (ECF). (Paragraph 4.22 (C)).

- The EFC is how RD maintains their internal package/file.

Change title of Exhibit 4-6 to ‘Establishing Minimum Area Loan Amount’ and to add an example of a minimum loan amount and leveraging funds with a local housing authority (Paragraph 4.24, Exhibit 4-6).

- The maximum loan amount that the applicant qualifies for as shown on the Eligibility Summary generated from UniFi may be too low to enable the applicant to purchase a property that meets program standards. Exhibit 4-6 outlines the procedure on how to handle this situation.

To modify language from ‘may’ to ‘will’ to provide consistency when an Energy Efficiency waiver is allowed. (Paragraph 4.24 (A)(4)).

- Given their resulting energy efficiency savings of up to 30 percent relative to typical new homes, as well as their progressive and routinely updated building standards, new homes constructed under the following national programs will be considered as a compensating factor…

- Although the wording has been changed to “will,” it still requires the RD Loan Originator and their next level supervisor approval.

Clarify the Loan Approval Official must sign Handbook Letter 15, Adverse Decision Letter (Paragraphs 4.24 Exhibit 4-6, 4.25 and Attachment 4-D).

To implement one 120-day timeframe for all applications issued a Certificate of Eligibility (COE), to eliminate the two different timeframes (Leveraging and 100% financing) and the two 30-day extensions. (Paragraph 4.25).

- The certificate is valid for a period of 120 days for all applications. Within that time the applicant must provide sufficient information to enable the Agency to conduct an appraisal of the property to be financed. The COE will be honored even if loan limits change before the expiration of the commitment. If the applicant has already submitted a contract for a property, Form RD 1944-59 will not be issued. If an applicant’s sales contract falls through, a new Form RD 1944-59, good for 120 days, should be issued. An application is no longer considered active and will be withdrawn when the certificate of eligibility has expired.

To update the location of the Attachment 4-A Worksheet for Computing Income & Max Loan Amount calculator (Attachment 4-A).

Make minor updates to reference ECF classifications, rather file positions and updated Area Loan Limit amount to conform to average HUD 203(b) limits.

- ECF = Electronic Customer File (RD’s)

Update Attachment 4-D to conform to changes to SAVE system.

- Attachment 4-D, “Reviewing Documentation for Citizenship Status:” Aliens and alien non-citizen nationals must provide acceptable evidence that they are qualified aliens as listed in Attachment 4-D.

Chapter 6

This chapter is being revised to provide updates to underwriting guidance related to refinance loans, allowable loan terms, and the annual loan quality review requirements along with other minor formatting changes. Changes include but are not limited to:

To clarify that the purchase and installation of essential equipment can be purchase new when those items are not included in the sale of the home or are not in working order.

Clarify the refinancing of a site with an existing dwelling requires a home inspection and that any noted deficiencies affecting decent, safe, and sanitary standards must be addressed as a loan condition.

Remove term ‘approved’ and replace with ‘insured’ for acceptable 10-year warranty plans purchased by the builder to allow 100% financing when other acceptable construction quality documentation is not available. This change aligns with HB-1-3550, Chapter 5 updates.

Provide additional instruction to clarify that Agency priorities for refinancing of existing borrowers will be provided through directives to prevent confusion that this option is allowed outside of those identified priorities (e.g., ARPA).

- Subject to the availability of funds and Agency priorities, Agency debt including subsidy recapture, may be refinanced as a special servicing option. When an existing Agency loan is being refinanced as a special servicing action in the limited circumstances provided in 7 CFR 3550.52 and 3550.201, the household’s adjusted income must not exceed the applicable moderate income limit for the area at the time of loan approval and closing.

Removed the language regarding the moderate-income limit in effect since it does not apply to the paragraph regarding note rates. Removed language regarding when the obligation date and approval dates differ, since the two dates should be the same date.

Paragraph 6.11(A)(3) was updated to correspond with the language in paragraph 6.11(A)(2).

3. Payment Assistance Method 2

- All other eligible applicants will receive payment assistance method 2. This includes applicants who receive new initial loans; borrowers obtaining subsequent loans who qualify for payment subsidy, but who are not currently receiving interest credit; and applicants who assume loans under new rates and terms. Borrowers who cease to receive interest credit or payment assistance method 1 for 6 months or more will receive payment assistance method 2 if they subsequently begin to receive payment subsidies. Paragraph 6.12 A describes the method for calculating payment assistance method 2.

Paragraph 6.17 to clarify that the applicant’s file should be electronically maintained in the Electronic Customer File (ECF) and updated to reference to Attachment 3-G, to correspond with the removal of Attachment 6-A.

- This is RD’s internal record keeping system.

Removal of Attachment 6-A and references within the chapter, and the section reserved for future Agency use as a placeholder. Staff survey provided that 90% of those surveyed were not aware of and do not utilize this attachment during underwriting and instead utilize Attachment 3-G, 502 Single Family Housing Checklist.

- Attachment 6-A was RD’s internal document to estimate the net recovery value representing the amount RD could expect to recover from a property if it was liquidated after considering all costs associated with liquidating, holding, and selling the property.

Update Attachment 6-B, Loan Quality Review, to address:

-

States who have an Internal Quality Review (ICR) scheduled will not be required to complete the 6-B review during the fiscal year of their ICR.

-

Removal of reference to Loan Approval Official (LAO) counseling applicant on payment shock to align with removal of payment shock counseling elsewhere in HB-1-3550.

Chapter 10

This Chapter is being revised to provide corresponding clarification to income, assets and issuing the Certificate of Eligibility. All website hyperlinks were checked for accuracy and updated accordingly throughout the chapter. Edits were made to:

To correct a grammatical error and update the term MortgageServ to LoanServ (Paragraph 10.4):

To remove the exception for a Certificate of Eligibility that leveraged loans have a 60-day timeframe for applicants to identify a property (Paragraph 10.8)

- Leverage loans no longer have a longer COE term but are now consistent with all other COEs for 120 days.

Update the language for the asset limitation to be consistent with Chapter 4 (Paragraph 10.9 (C)

- C. Loan-to-Value Ratio

- When loans are funded solely by the Agency, the applicant’s total debt may exceed the market value of the property by the total of the Agency appraisal and tax monitoring fees, the required contribution to establish the escrow account, plus the fee for homeownership education. Down payments are required only if the nonelderly households cash value of non-retirement assets exceed $15,000 ($20,000 for elderly households). (See Paragraph 4.6.)

Appendix 3 is being revised to update HB Letters 11, 12, 17 and 18. Edits were made to:

- HB Letter 11 – Request Information – to update the National Appeals Division (NAD) website to file for an appeal.

- HB Letter 12 – Notice of Approval (504 Grants and/or Loan)- updated confusing language related to homeowners written satisfaction statement.

- HB Letter 17 – Adverse Decision Involving an Appraisal – modified to reflect one 120-day timeframe for all applications when reissuing the Certificate of Eligibility.

- If the sales contract falls through, a new Form RD 1944-59, Certificate of Eligibility, good for 120 days, may be issued by contacting your Local Office.

- HB Letter 18 – Unfavorable Decision After Technical Review of an Appraisal – modified to reflect one 120-day timeframe for all applications when reissuing the Certificate of Eligibility.

Appendix 10: These changes will increase grant obligations and better serve areas impacted by natural disasters.

- Added allowance to serve both presidentially declared disaster areas (individual and public assistance).Added direction that funds received from FEMA, while considered to determine whether there is a duplication of benefits, should not be considered net family assets calculations.

- Added allowance to use the regulatory maximum grant assistance of 10% the national area loan limit.

Also in this issue of Self-Help Builder: